Recent headlines on some high-profile short squeezes have caused some investors to contemplate the wisdom of shorting individual names. Our investment team has avoided single stock shorts since the inception of the Lake Geneva Fund Strategy, as we do not believe it remains an effective risk management tool for our strategy for multiple reasons.

First, our team spends zero time researching “bad” companies; we are not interested in poor fundamentals or marginal management teams. Furthermore, a single stock short is inconsistent with our overall consolidation thesis for small and mid-cap innovation companies. In our areas of strategic focus, even the more poorly positioned companies get “taken out” by larger corporates which are value shopping or by the plethora of growth and private equity investors who are flush with cash and competing for deals. In our experience, we believe it is often the fallen angel (a once high flier that sells off post an earnings expectation miss or other disappointing news) that draws the attention of a strategic buyer or private investor who has a longer time horizon. In lieu of shorting an individual name, the Pier 88 Investment Team has developed a risk management process which employs multiple tools to help mitigate idiosyncratic and systematic risk. These tools include disciplined position sizing, continual risk/reward analysis, use of options and convertible bonds, strategic ETF shorting and custom swaps. Our philosophical approach has focused on risk management and capital perseveration as opposed to alpha shorting.

According to Goldman Sachs Prime Brokerage, on January 27th, fundamental HFs lost 4.7% with negative 3.5% alpha, which allegedly was one of the worst daily alpha results in recent times. Asset selection on the short side (short squeeze) and the sell-off of both long and short concentrated positions were noted as among the key drivers of negative alpha. Other Prime Brokerage teams also witnessed significant forced selling of long positions to cover short positions.

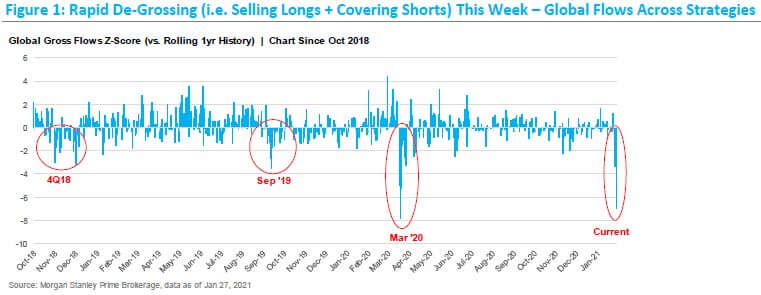

We submit that the benefits of alpha shorting may be more elusive than many in the industry perceive or admit. Over the years our portfolios have benefitted from multiple short squeezes. Our anecdotal observations led us to suspect that hedge funds were trafficking in the same names on the long side and short side. We wondered whether it was the structural biases inherent in the hedge fund pod structure – where analysts/PMs were encouraged or mandated to have a specific number of longs and shorts – that drove this common name behavior. We struggle to understand the wisdom of forcing an investment decision to fit into an inflexible formula and have seen this behavior lead to herding activity. In our view this “safety in numbers” or “wisdom of crowds” approach seemed fraught with risk. The following chart is illustrative.

The positive year to date performance of heavily shorted stocks has been eye popping.

One might suggest that there are too many predators and not enough prey for the single stock short to systematically continually work. We are cognizant of the potential one-time large pay-off of identifying the next fraudulent company like Enron or WorldCom. However, we prefer the on-going benefits of a risk management process which aims to reduce idiosyncratic and systematic risk, thereby preserving capital and enabling one to play offense while others are on the defensive.

Important Disclosures:

This letter is a proprietary publication and the property of Pier 88 Investment Partners, LLC (“Pier 88”). The publication is written to express our view of the market and to explain our investment philosophy. It is not intended to provide specific investment advice or to guarantee that any past performance will be indicative of future performance results; investments may lose money. Certain statements contained in this newsletter (such as those that contain words like “may,” “will,” should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe”) are “forward-looking” insofar as they attempt to describe beliefs or future events. No representation or warranty is made as to future performance or such forward-looking statements. Any reproduction or other unauthorized use is strictly prohibited. All information contained in the letter was obtained from sources deemed qualified and reliable; however Pier 88 makes no representation or warranty as to the accuracy of the information contained herein. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can of themselves be used or assist any person in making investment decisions.

References to market or composite indices, benchmarks, or other measures of relative market performance over a specified period of time are provided for information only. Reference or comparison to an index does not imply that the portfolio will be constructed in the same way as the index or achieve returns, volatility, or other results similar to the index. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Unlike indices, the funds are actively managed and may include substantially fewer and different securities than those comprising each index.

Performance results of the funds are presented for information purposes only and reflect the impact that material economic and market factors had on the manager’s decision-making process. Results are net of all standard fees calculated at the highest rate charged, expenses and estimated incentive allocation. The funds’ returns are inclusive of the reinvestment of dividends and other earnings, including income from new issues. Returns may vary for investors.

The holdings identified do not represent all of the securities purchased, sold, or recommended for the funds. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities in this list. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the account’s performance during the period will be provided upon request.

The companies identified do not represent all of the companies purchased, sold or recommended for portfolios advised by Pier 88 Investment Partners, LLC. The reader should not assume that investment in any company was or will be profitable. Additional information including a list of all companies is available upon request.